Abstract

Abstract  Abstract

Abstract

Bsengine computes the fair value of european style options based on

the current stock price. Aditionally, several computations are given;

greeks, spread, breakeven, Omega, Gear, Rho. It uses the option pricing

algorithm of Black, F. and Scholes, M, the architects of the

option pricing model. The software was written in C on a SUN

workstation, its primary design was to run as a backoffice processor.

The code itself was optimized for running under the Linux operating

system. However, the author has built this software successfully on

Windoze, but just for testing purposes and not for productional use

because of well known operating system deficits.

Design goal

Initial reason that I wrote this software was my personal requirement that I needed a software which should be able to receive data from a stock exchange server which can be used for recruiting warrants considering my personal and individual risk profile. An additional design goal was that the system should be independent of slow represented online banking websites containing advertisements and other crap. Third and most important reason for writing the software was the cognition of finding inconsistent product informations and miscalculations on the website from my broker. I don't really trust these kind of online banking systems currently around. Investing my money trusting my own calculations is the way I like. Bsengine was typically designed for industrial processing of batch data e.g. to compute and populate a broker website automatically (e.g. similar like Swissquote or Consors sites). The bsengine kernel includes a plain CLI interface and the system was designed to be modular and fast. An advantage of this concept is that the software can be used unattended as a part of a huge batch processing concept. If you like to hack a Gtk+ frontend around the kernel, fell free!

Postprocessing notes

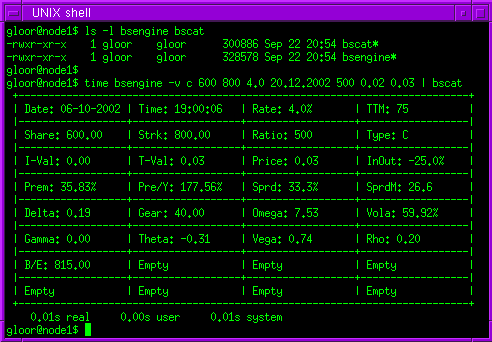

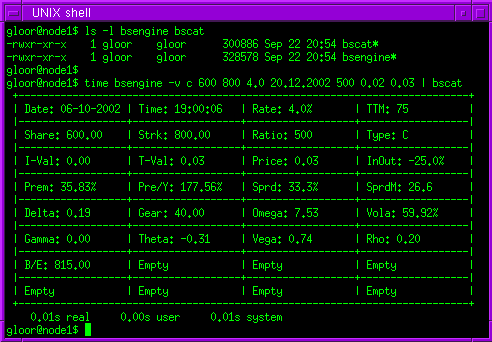

Once the mathematical calculation based on a complex derivative option

pricing model has been finished, bsengine will write its results to

stdout(), normally to a computer screen. The standard output method of

bsengine is a token separated data-string which can easily be parsed

from a productional batch processing subprocess. Using this facility,

the token separated string given from bsengine is loaded in to a

relational database management backend system (RDBMS) for further post

processing of the data (e.g. a mySQL

database server). I wrote an additional application called bscat

(bsengine catalog) which reads bsengine's output from stdout via Unix

pipe into stdin and prepares a new output in a human readable format (a

shown in screenshot above).

Technical notes

The bsengine kernel and bscat was fully written in C and should be

easily portable to other Unix environments or operating systems which

supports pipes. I developped the software on a SUN Sparc 5 running

GNU/Linux. To compute the implied volatility, a fast approximation

formula was required. I use the "Newton-Raphson" algorithm to

numerically determing the volatility of an option using the generalized

Black-Scholes model, given its market price. The "Manaster and Koehler"

algorithm is responsible for the initial value used for iterations, this

is the main reason, that bsengine is very fast computing option prices.

Bsengine was tested hours and hours by feeding in real time data from a

trading system. This software is ready for productional use, please note

that the bsengine package was published under the terms of the GNU General Public License which

clearly implies, that this software comes without any warranty.

Future plans and additional feautures

Basically, no software is finished and bsengine is a release of my

development source tree of bsengine, in other words it's a WIP (work in

progress) snapshot. I plan to expand the capabilites of bsengine as soon

I get access to a free or favourable stock exchange interface. To find

an adequate offer is a real problem and this is the main reason why

further development of besengine has been terminated. Computing option

prices has to be in real-time. However, current status of bsengine is

that the software is fast and well working. If you have any suggestions,

comments or contributions, feel free to get in touch with me by sending

me an email.

Examples of bsengine and bscat in action

gloor@node1$ ./bsengine -h

bsengine 1.0.0 - Black/Scholes Option pricing (UNIX)

written by Marc Gloor <marc_dot_gloor_at_u_dot_nus_dot_edu>

usage : bsengine [options] [arguments]

example: bsengine -v c 6024.2 8000 4.0 20.10.2002 500 0.02

0.03

options are:

-h show

help

-v compute priced volatility

-r show

release

-p compute fair price

-v arguments are (in correct order): -p

arguments are (in correct order):

-1st Call/Put flag

[c/p]

-1st Call/Put flag [c/p]

-2nd Underlying price

[dec]

-2nd Underlying price [dec]

-3rd Strike price

[dec]

-3rd Strike price [dec]

-4th Interest Rate in %

[dec] -4th

Interest Rate in % [dec]

-5th T.t. Maturity

[dd.mm.yyyy] -5th T.t.

Maturity [dd.mm.yyyy]

-6th Options ratio

[dec]

-6th Options ratio [dec]

-7th Bid price

[dec]

-7th Given volatility in % [dec]

-8th Ask price [dec]

For productional environments, for example you intend to populate a

relational database using following command:

gloor@node1$ ./bsengine -v c 6024.2 8000 4.0 20.10.2002 500 0.02

0.02

Here is an example of the semicolon separated data output:

22-09-2002;20:08:12;C;6024.20;8000.00;500;28;4.0%;0.03;55.63%;-24.7%;...

Here is an example of the bsengine and bscat working together (e.g. assembling a website using a CGI script):

gloor@node1$ bsengine -v c 6024.2 8000 4.0 20.10.2002 500 0.02

0.03 | bscat

+---------------------------------------------------------------------------+

| Date: 22-09-2002 | Time: 20:09:08 | Rate:

4.0% | TTM:

28 |

|------------------+------------------+------------------+------------------|

| Share: 6024.20 | Strk:

8000.00 | Ratio:

500 | Type:

C |

|------------------+------------------+------------------+------------------|

| I-Val: 0.00 | T-Val:

0.03 | Price:

0.03 | InOut: -24.7% |

|------------------+------------------+------------------+------------------|

| Prem: 33.05% | Pre/Y:

1179.91% | Sprd: 33.3% | SprdM:

119.8 |

|------------------+------------------+------------------+------------------|

| Delta: 0.04 | Gear:

401.61 | Omega: 16.77 |

Vola: 55.63% |

|------------------+------------------+------------------+------------------|

| Gamma: 0.00 | Theta:

-1.52 | Vega:

1.50 | Rho:

0.18 |

|------------------+------------------+------------------+------------------|

| B/E: 8015.00 |

Empty

|

Empty

|

Empty |

|------------------+------------------+------------------+------------------|

|

Empty

|

Empty

|

Empty

|

Empty |

+---------------------------------------------------------------------------+

Data field description

Date: timestamp

date

Pre/Y: premium per annum

Time: timestamp

time

Sprd: spread

Rate: interest

rate

SprdM: spread Move

TTM: time to

maturity

Delta: delta

Share: share

price

Gear: gearing

Strk: options strike

price Omega: omega

Ratio: options

ratio

Vola: implied volatility

Type: type

(Call/Put)

Gamma: gamma

I-Val: internal

value

Theta: theta

T-Val: time

value

Vega: vega

Price: Options faire

price Rho: rho

InOut: In/Out of the

money B/E: break

even

Prem: premium

Benchmark

The result of a computing simulation of 20'000 options prices was

displayed in seconds, higher performance depends on the current workload

and of your hardware. Binary was optimized for Linux (stripped code).

License

The distribution is licensed under the GNU General Public License.

Download the latest release

Currently no documentation and sourcecode available (send me an

email), please read the description above before running bsengine.

Bsengine 1.0.0, statically linked binary only version for linux: bsengine-1.0.0_stat_bin.tar.gz

[.tgz, 262kb].

If you need any further assistance, let me know.

$Id: bsengine.html,v 1.21 2026/02/20 23:31:03 gloor Exp $ |